Miami’s mayor backed MiamiCoin crypto – then its price dropped 95%

05/24/2022 / By News Editors

On Feb. 2, the city of Miami cashed out its cryptocurrency MiamiCoin for the first time, depositing $5.25 million into city coffers. Miami mayor Francis Suarez hailed it as a “historic moment” and predicted the cryptocurrency could one day even replace municipal taxes as the government’s primary source of funding.

(Article by Scott Nover & Camille Squires republished from QZ.com)

MiamiCoin’s creator, an organization called CityCoins, has been no less enthusiastic, portraying the coin as a financial experiment that will empower citizens with a “community-driven revenue stream” while spurring new digital city services.

Miami is not the only city with big cryptocurrency dreams. CityCoins announced a similar cryptocurrency for New York in November 2021, and plans to release a coin for Austin, Texas, soon. Other cities have launched their own crypto ventures: Fort Worth, Texas, for example, will soon be running bitcoin mining rigs in city hall.

But only Miami’s mayor has thrown his full endorsement behind a CityCoin-branded cryptocurrency so far. After promoting MiamiCoin to residents and investors since its launch in August, the city of Miami received millions of dollars through its agreement with CityCoins.

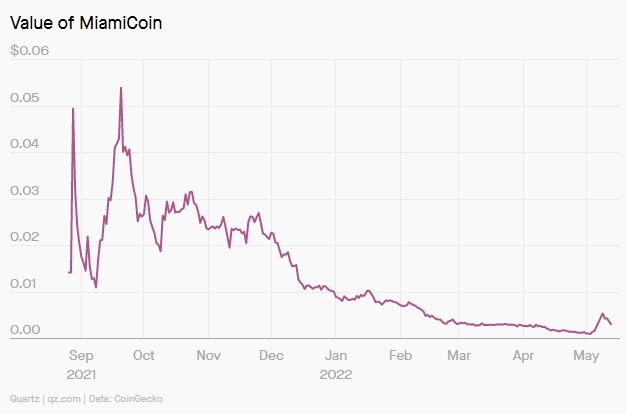

Over the last nine months, however, MiamiCoin has lost nearly all of its value, falling about 95% from its September peak to just $0.0032 as of May 13. Its rapid descent has burned investors on the way down, muting the dreams of Miami’s city leaders, and possibly raising red flags for regulators now investigating cryptocurrency transactions.

Miami’s mayor is CityCoins’ biggest booster

MiamiCoin is the first in what CityCoins, a Delaware-based company with a mailing address in a Los Angeles strip mall, has promised will be a series of US city-branded cryptocurrencies. New York City mayor Eric Adams tweeted his approval of NYCCoin on Nov. 8, shortly after his election, welcoming CityCoins to “the global home of Web3” (Web3 is a crypto-optimist idea of a decentralized internet built on blockchains and cryptocurrencies). But Adams hasn’t spoken of NYCCoin since taking office on Jan. 1 of this year, and the coin has fallen 68% since then. Meanwhile, Philadelphia’s government has explored the CityCoins idea, but announced in April it would not proceed.

Miami has forged ahead, though. In October 2021, it signed a “gift agreement” with CityCoins, allowing Miami to receive proceeds from the coin. The city does not own or manage the cryptocurrency, however. (Suarez has caveated in public statements that the city is only a legal beneficiary.)

At the outset, the arrangement benefited both Suarez and CityCoins. CityCoins has needed the backing of big-city mayors as it promotes more cryptocurrencies. And Suarez, a rising Republican star with national electoral ambitions, has made it clear he believes MiamiCoin can burnish his own image as a pro-tech politician.

At the opening plenary for the annual Bitcoin conference in Miami on April 6, Suarez called himself the “most bitcoin-friendly mayor on the planet,” touting his plan to let city employees receive their salaries in bitcoin. After teasing the possibility of a 2024 presidential campaign, he laid out what he called “a vision for bitcoin America 2024,” asserting that the next US president had to be a “pro-bitcoin candidate.”

By carving out this political lane, Suarez has increased his appeal to the deep-pocketed Silicon Valley libertarians and cryptocurrency disciples he has recruited to relocate to Miami over the last two years. In 2020, Miami attracted 15% more tech workers in 2020 compared to before the pandemic, while a record $4.6 billion in new venture capital investment poured into its tech sector in 2021.

Emails between CityCoins and Miami officials, obtained by Quartz through a freedom of information request, reveal a close partnership to promote MiamiCoin to the local tech community. The documents show Patrick Stanley, who identifies himself in interviews and on social media as a CityCoins “contributor” and “community lead,” was the most frequent point of contact for city officials.

In one email on Oct. 8, 2021, Stanley pushed city officials to recruit tech representatives to build trust within the Miami tech scene. “This weekend [Miami chief innovation officer Mike Sarasti] is going to try to find some names of people in the local area that can establish trust locally,” Stanley wrote. “This will get a lot of pushback in Miami unless there is an OG Miami tech crew who can bridge the gap,” referring to established, trusted figures in the city’s tech community.

“We don’t want crypto anarchy”

Stanley has been at the helm of a number of projects based on blockchain technology. Those include Stacks, a company that created the infrastructure MiamiCoin now depends on. He started CityCoins with the promise that it would generate income for local governments and spur tech innovation among city residents.

While crypto advocates typically preach independence from state and financial institutions, Stanley sees government and crypto as natural partners. “We don’t want crypto anarchy,” he said in a phone interview with Quartz. “It’s more like, ‘crypto civilization.’ Our whole goal is to increase happiness, health, and wealth for citizens. We’re not a replacement for governments, we want to increase state capacity.”

No models currently exist for how US cities can incorporate cryptocurrencies into their economies and government operations. But Stanley argues that MiamiCoin will be used for local business transactions, facilitate software development, and even one day furnish a source of a universal basic income for residents. Stacks is also running an accelerator program for CityCoins, and recently accepted 11 new companies to build gaming, educational, and financial apps for its cities.

Even as MiamiCoin’s price plummets, Stanley insists that it can and will have practical applications soon. In an interview, he acknowledged legitimate criticisms of cryptocurrencies, a space rife with scams, deceit, and puffery, but insisted CityCoins is an exception, a rare crypto product with transformative potential. “One type of person thinks that everything in crypto is a scam,” Stanley told Quartz. “Another type of person thinks ninety-nine percent of crypto is a scam but one percent is insanely important. I’m in that latter group. Bitcoin, Stacks, Ethereum, CityCoins. That all falls in that one percent of projects that are not only not scams, but incredibly important.”

“A few regulatory wires the Mayor has tripped”

Since MiamiCoin still exists in an unproven regulatory gray area, CityCoins and Miami are wary of setting off alarms with the US Securities & Exchange Commission, which has prosecuted cryptocurrencies as unregistered securities in the past.

One email obtained by Quartz shows that CityCoins was concerned about raising flags with the federal government. On Oct. 6, 2021, Kara Miley, an outside press representative for CityCoins, sent an email to Suarez’s chief of staff saying the mayor had caused problems in his media appearances talking about MiamiCoin.

“We need to get an hour with the Mayor for a comms training session on CityCoins and MiamiCoin. It’s great that he is doing press but he would greatly benefit from an hour session with Patrick on how to best communicate the project. There are a few regulatory wires the Mayor has tripped in recent interviews and it’s really important for the sustainability of the project that he is better prepared. We really care about the Mayor and his role in making MiamiCoin a success—it’s critical that we get time with him as soon as possible.”

The email did not specify the regulatory concerns.

Representatives from the Miami mayor’s office did not respond to multiple requests for comment about MiamiCoin. Stanley defended MiamiCoin in an email to Quartz, arguing that Miley had mistakenly “overstated” the concerns, and that Suarez was “well within his bounds” during interviews. Miley told Quartz that she sent the email to Suarez’s team “out of an abundance of caution, but he had not in fact tripped any [regulatory] wires.”

John Reed Stark, a former chief of the SEC’s Office of Internet Enforcement, said the email itself is a red flag for regulators searching for potential wrongdoing. “The SEC could very easily see an email like this, become concerned, open up a formal investigation, and issue subpoenas to everyone as to what’s going on,” he said by phone.

If the SEC investigates and determines that MiamiCoin is, in fact, an unregistered security, CityCoins and the City of Miami could be forced to return investors’ money. Were the SEC to find that anyone involved made misleading public statements about MiamiCoin, the agency could implicate the organizers in securities fraud.

The SEC has already sued companies over cryptocurrencies it deems are unregistered securities. It’s not a stretch to argue that residents of crypto-using municipalities also need protections, just like investors. “Their fiscal future is in jeopardy if a municipality is committing any sort of fraud or any sort of registration violation,” Stark says.

What is MiamiCoin?

So far, MiamiCoin remains a purely speculative asset. Neither the city itself nor private merchants appear to accept the cryptocurrency in exchange for goods or services. CityCoins was able to point to one potential city project (proposed but not yet implemented) involving a city contractor that would use the cryptocurrency to reward residents for reporting incorrectly parked rideshare scooters to the city’s 311 phone service.

Instead, MiamiCoin has primarily served as a volatile asset that makes money for the city government based on its value among investors who mine and trade it on the crypto market.

Anyone can theoretically purchase MiamiCoin on an exchange or mine new tokens by paying to enter a digital lottery in which new tokens are issued. The cryptocurrency’s value rises and falls based on demand from these speculative investors or miners. A wallet reserved for the municipal government automatically receives 30% of the money wagered on mining the cryptocurrency. So far, the coin has brought in $5.25 million. The city’s wallet of unclaimed money, once topping $15 million reserved in a different cryptocurrency called STX, has fallen to less than half that amount.

In February, Miami city commissioners voted to allocate earnings from MiamiCoin to rental assistance for Miami residents whose rents have increased by more than 20% in the past year. More than 800 qualified residents could receive $1,000 per month for six months, according to the Miami Herald.

CityCoins also recently introduced a way for token holders to propose and vote on suggestions for how the city might use revenue from the cryptocurrency. Stanley told Wired he hoped the voting feature would entice people who actually live in a coin’s namesake city to buy the currency.

Trading and mining MiamiCoin

MiamiCoin is unlikely to catch on, if only because it is so hard for the average citizen to obtain. Most major cryptocurrencies are traded on popular exchanges such as Coinbase or Binance, but MiamiCoin is listed on just one exchange, OkCoin, the 26th-largest exchange by volume, according to CoinMarketCap. This means even seasoned crypto holders would likely need to create a new account in order to access MiamiCoin—and without a large number of traders or the liquidity of the big exchanges, it could be challenging for investors to cash out.

Mining MiamiCoin is even harder to do. MiamiCoin relies on the Stacks (STX) cryptocurrency infrastructure, a blockchain protocol that lets web developers build applications on top of the bitcoin blockchain. Stacks, where Stanley was once an executive, has raised $94 million in funding since 2019.

After registering with Stacks and acquiring STX tokens, prospective miners must bid hundreds of dollars worth of STX on “blocks” of MiamiCoin via the website MineCityCoins.com. By wagering more STX, miners can increase their chances of winning a block, not unlike a raffle in which buying tickets increases one’s likelihood of winning a prize. Once a miner wins the block, the city of Miami gets 30% of the bids paid in STX.

Is crypto a good investment for Miami?

Stanley said it’s too early to judge MiamiCoin’s value, emphasizing that the coin is still in its infancy. “It’s crawling right now,” Stanley told Quartz on April 6. “We want to see it walk. We want to see it run.” Eventually, he says, it could mature into an “open-source app ecosystem…a mini ethereum” for Miami-based projects, comparing it to the popular blockchain, which has enabled the rise of decentralized applications and nonfungible tokens.

But critics say Miami’s embrace of MiamiCoin diverts city resources, including employee time and attention, from immediate problems such as income inequality and housing affordability.

“I wish local leaders would approach cryptocurrencies… by asking what problems are we trying to solve and are the risks greater than the benefits,” says Brookings Institution fellow Tonantzin Carmona, who formerly worked as the policy chief for the Chicago City Clerk and as a director of the Office of New Americans in the Chicago mayor’s office.

Carmona draws a straight line between the endorsement of risky, unregulated assets like cryptocurrencies and financial products like payday loans and subprime mortgages. She sees it as part of the legacy of “predatory inclusion,” offering low-income people access to the financial system but on risky, exploitative terms that may burn vulnerable individuals. “Proponents argue that crypto will lead to financial inclusion, but that access comes at a cost that compromises the benefits,” says Carmona. “Cryptocurrencies are volatile, they’re risky, complex, and the space is ripe with scams, frauds, and hacks.”

That is precisely the scenario that played out in El Salvador, the first country to adopt bitcoin as legal tender. Individual citizens have lost money making bitcoin transactions. The entire nation’s economy has been compromised in the eyes of international creditors. The International Monetary Fund, which is negotiating with El Salvador over a $1.3 billion loan, issued a report in January strongly urging the country to drop bitcoin as legal tender.

Even if MiamiCoin users don’t get burned, the reserve funds in the city’s wallet will eventually dry up if people lose interest in the currency. While some see the MiamiCoin arrangement as a can’t-lose proposition for the city, the money will stop flowing to government coffers if the underlying utility or ongoing speculation doesn’t bolster the price, says Michael Bloomberg, an urban technology researcher at Cornell Tech. “People will stop mining the coin if they can’t make money off of it, and the only way they make money off of it is convincing greater fools to participate.”

In Florida, that reality may be sinking in. This February, as MiamiCoin’s price tanked to less than half of one cent, Suarez conceded to the Miami Herald that the project might fail. “Innovation doesn’t always work,” he told the newspaper. But Suarez still appears to believe in the power of cryptocurrencies to transform local government, touting “the impact this technology will have on democracy,” while speaking at a Miami tech conference on April 19.

For his part, Stanley is not worried about MiamiCoin’s price collapse. He feels that with more buy-in from investors and developers, the price will eventually recover. (CityCoins users recently voted to change the rate at which new quantities of coins are released, a move expected to bolster its price.) “We have seen this movie before and the market is a little behind what is happening and what is to come,” he wrote by email in April. “The score will take care of itself. No serious stakeholder expects their investment to go up and to the right, and we are patient.”

Stanley, who has mined MiamiCoin himself (he didn’t disclose how much he holds), says he is “breakeven” on the investment. He doesn’t plan to sell.

Read more at: QZ.com

Submit a correction >>

Tagged Under:

big government, bitcoin, Bubble, CityCoins, Collapse, conspiracy, cryptocurrency, currency crash, debt collapse, deception, economy, finance, Francis Suarez, government debt, investment, market crash, MiamiCoin, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BITCOINCOLLAPSE.NEWS

All content posted on this site is protected under Free Speech. BitcoinCollapse.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. BitcoinCollapse.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.